- Article

- Managing Cash Flow

- Enable Growth

The Rise of Middle Office Outsourcing in Asia

Alan Fong

SENIOR PRODUCT MANAGER, ASSET MANAGER SECTOR, SECURITIES SERVICES, HSBC

A collection of recently published insights from Alan Fong.

Sal Nayeer

DIRECTOR OF MIDDLE OFFICE PRODUCT ASIA, SECURITIES SERVICES, HSBC

A collection of recently published insights from Sal Nayeer.

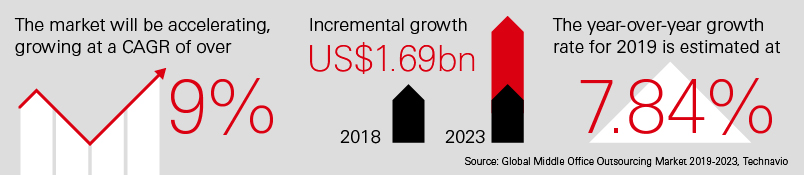

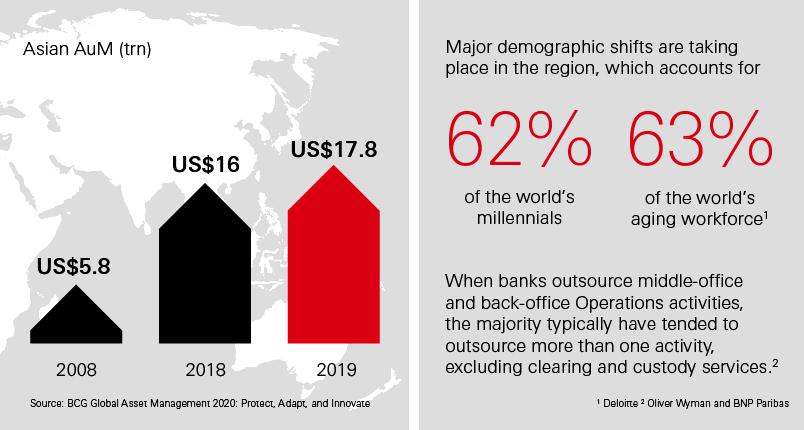

The Asian asset management industry has experienced double digit growth for most of the past decade; driven by sustained economic growth, a burgeoning middle class and an increasing need for retirement savings. The future outlook remains positive, despite the current headwinds from the COVID-19 outbreak and geopolitical tensions.

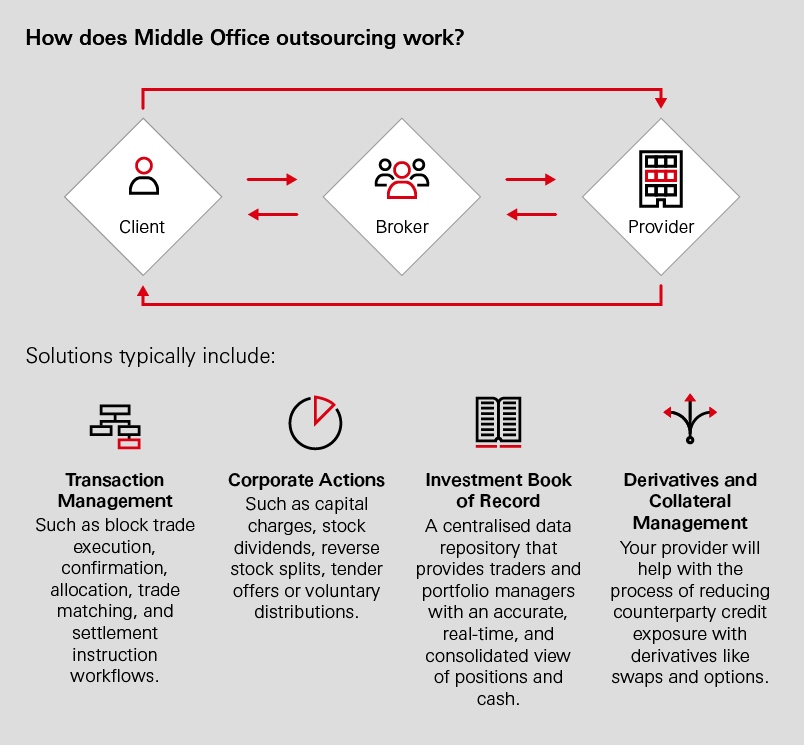

As the market grows, asset managers need to focus on the fundamentals and restructure their operating models in order to accommodate growth and manage costs. This search for efficiency and cost-effectiveness is driving outsourcing of non-core activities globally and more recently, in the region. It has become relatively commonplace to see Asian asset managers outsource back office services such as fund administration. But today, they are looking further up the value chain, setting their sights on the outsourcing of middle office operations.

Middle office outsourcing is still in its infancy in many Asian markets, but it has been growing here as asset managers recognise the benefits in cost, managing risk, easing regulatory burden, and gaining access to up-to-date technologies. Outsourcing providers offer platforms that can scale and manage complexity, and facilitate growth in global markets investments.

The hurdles of the past

In the past, asset managers have sometimes been reluctant to embrace middle office outsourcing, often because of a perceived lack of control, across a sensitive area of operations. However advancements in reporting, real time dashboards and data visualisation now help to mitigate these concerns.

“There's a tendency to look at outsourcing in general as purely cost reduction, but this is not always the case for middle office outsourcing. Cost is an element, but so are the qualitative factors that drive benefits. While staffing and premises may be cheaper in some Asian markets, scaling to a global operating model, access to robust technology, managing risk and navigating regulatory challenges are also compelling reasons that need to be part of the discussion,” says Sal Nayeer, Director of Middle Office Product in Asia for Securities Services at HSBC.

There's a tendency to look at outsourcing in general as purely cost reduction, but this is not always the case for middle office outsourcing. Cost is an element, but so are the qualitative factors that drive benefits

Rules around outsourcing regulations have also been a hurdle in the region. In some countries, there are no specific regulations in place that cover middle office outsourcing. Other countries’ guidelines are not specific about which activities can be outsourced and if the related activities can be moved offshore.

However, the tide is turning as interest in middle office outsourcing grows. Both providers and asset management firms are lobbying regulators to provide guidance on permitted activities. As a result, middle office regulations have been clarified somewhat in recent years. In markets that are still behind the curve, lobbying continues.

Renewed interest in outsourcing

Growth in trade volumes, trading in new markets and more complex assets, such as derivatives, are encouraging asset managers to consider outsourcing. These activities require a more mature skillset and accessing overseas markets means meeting international standards.

An experienced middle office service provider can offer a global operating model and the requisite skills to navigate the complexity of trading more bespoke instruments or entering new markets.

“The recent market volatility, in addition to work from home requirements caused by the COVID-19 pandemic, have highlighted that some asset managers in the region may not have the scale and infrastructure to manage their operations and associated operational risk effectively,” says Alan Fong, Senior Product Manager in the Asset Manager Sector for Securities Services at HSBC.

The recent market volatility has highlighted that some asset managers in the region may not have the scale and infrastructure to manage their operations and associated operational risk effectively

Asian managers can leapfrog to next-gen

Asset managers in Asia that outsource their middle office can reduce the burden of non-core activities for the front office, so that they can concentrate on portfolio management and growing their asset base, generating performance and returns. They will also gain access to the latest technology, allowing them to scale their business on a robust platform, without the associated costs of upgrading and maintaining systems in-house. An established middle office provider typically operates a global platform that is integrated into the wider market infrastructure. Establishing a platform of that scale, complexity and technological standard is cost-prohibitive for some managers.

Navigating the FinTech age is another key motivator for Asian asset managers, who are seeking digitally-savvy outsourcing partners. Some Asian asset firms still incorporate manual tools, such as fax machines, as the markets they operate in continue to be paper-based for some processes. An outsource provider has access to digital tools that can help them to overcome these manual hurdles.

Further, asset managers have well thought out data aspirations as they have realised the huge value to be extracted from richer and timelier data that can provide vital insights. Due to the intraday nature of middle office processing activities and time sensitivities involved, oversight tools and demand for earlier data has increased – particularly around the Investment Book of Record (IBOR).

The benefits of Middle Office Outsourcing in Asia

- Most Asian managers are typically smaller in size than their US and European counterparts and do not have the resources to implement and maintain an in-house middle office operation that is scalable and globally competitive.

- The cost/benefit analysis is changing as Asian asset managers factor in the rising toll of regulatory risk, scaling operations and the need for cutting edge tech.

- Lobbying from providers and asset managers is making the rules around outsourcing clearer and adoption easier.

- An experienced middle office service provider can offer a global operating model and the requisite skills to navigate the complexity of trading more bespoke instruments or entering new markets.

- A digital-savvy partner can help Asian asset managers compete in the FinTech age and realise their data aspirations.

- Ultimately, asset managers in Asia that outsource their middle office can reduce the burden of non-core activities for the front office, so that they can concentrate on portfolio management and growing their asset base, generating returns and managing risks.